Insurance technology pioneers and thought leaders converged at InsureTech Connect (ITC) 2024 at Mandalay Bay in Las Vegas, where AI and digital transformation took center stage. ITC provided an excellent opportunity to connect with my Vitech colleagues, reunite with old friends like Karen Lindokken from the Standard (SIC), and forge new relationships. I also had the pleasure of leading an innovative joint Vitech-Cognizant presentation showcasing how emerging technologies are revolutionizing group insurance—from service delivery to customer experience and operational efficiency.

Insurance technology pioneers and thought leaders converged at InsureTech Connect (ITC) 2024 at Mandalay Bay in Las Vegas, where AI and digital transformation took center stage. ITC provided an excellent opportunity to connect with my Vitech colleagues, reunite with old friends like Karen Lindokken from the Standard (SIC), and forge new relationships. I also had the pleasure of leading an innovative joint Vitech-Cognizant presentation showcasing how emerging technologies are revolutionizing group insurance—from service delivery to customer experience and operational efficiency.

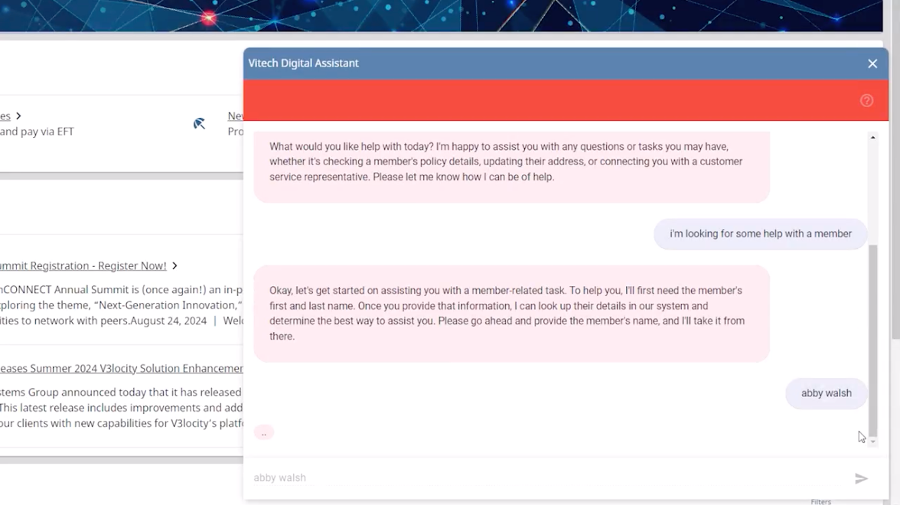

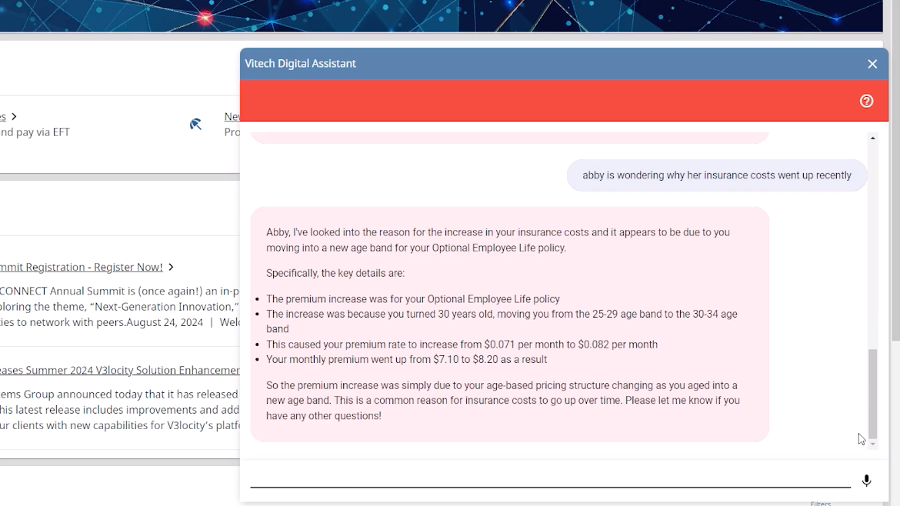

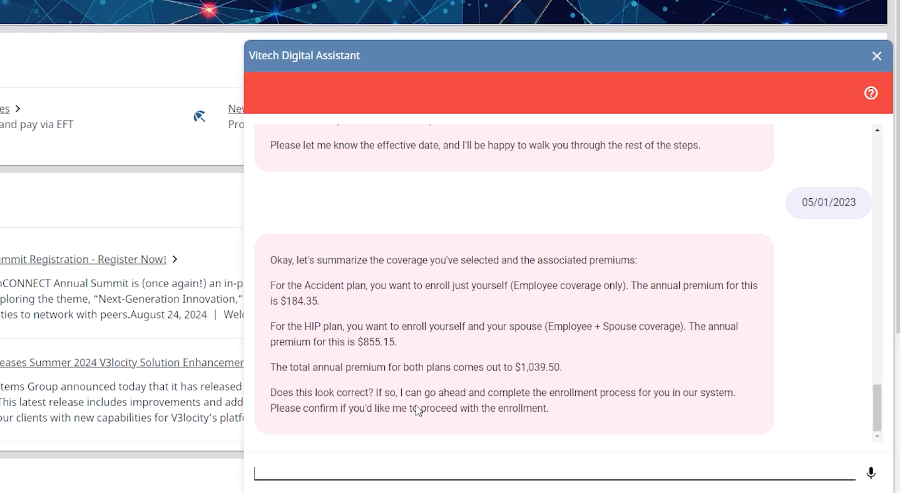

Our session unveiled Vitech’s latest innovation: the Vitech Digital Assistant – a GenAI-powered solution designed to revolutionize group insurance operations. Through a live demonstration, we showcased how this technology streamlines benefits management for employers, plan members, brokers, and staff. To illustrate its capabilities, we demonstrated how the Vitech Digital Assistant handles one of the most common customer queries: “Why did my premium increase?” This real-world example highlighted the system’s practical impact on day-to-day insurance operations.

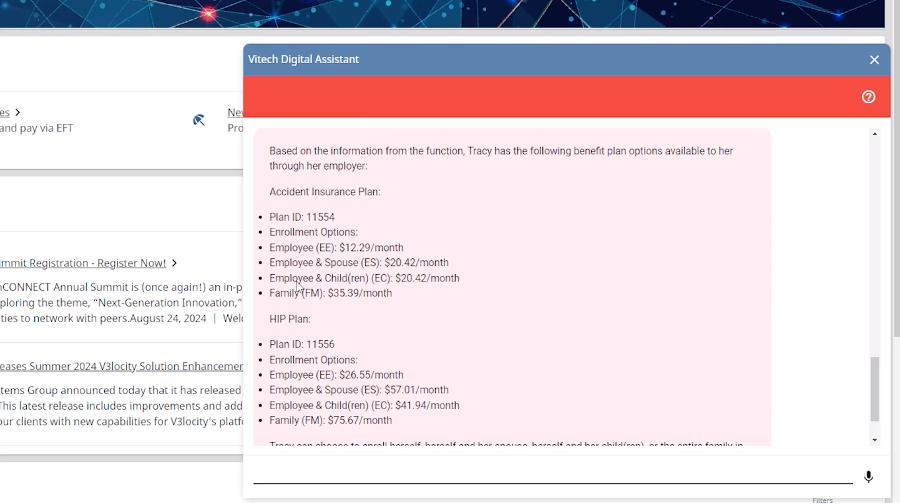

There are so many opportunities within the Group Benefits space for Jarvis to provide value so we could have presented for hours. However, for time purposes, we only touched on one other key area regarding benefits enrollment:

The presentation emphasized how the Vitech Digital Assistant streamlines common insurance-related tasks and inquiries through simple conversational interactions, making the process more efficient for all users. During the presentation, several audience members commented on the solution’s intuitive interface and real-time processing capabilities, noting its potential to transform operations. This development represents a significant step forward in applying AI to common insurance industry challenges.

The insurance industry is witnessing a pivotal shift in how technology can enhance every aspect of operations, and Vitech’s GenAI initiatives are already delivering measurable improvements in efficiency and customer satisfaction.

As ITC 2024 demonstrated, the insurance industry stands at a transformative crossroads where GenAI is not just a future possibility, but a present reality delivering measurable results. As we continue to witness the evolution of these solutions, it’s clear that organizations embracing AI-driven transformation today are positioning themselves to deliver superior service and value to their customers.

To learn more about Vitech’s innovative solutions or schedule a demonstration of the Vitech Digital Assistant, contact our team here.